|

| 2010 IRS Income Tax Brackets

January 15, 2010

For 2010 taxes ( income from year 2010 ) these are the tax brackets

that you will use to determine where you

stand with the IRS.

For more specific information

please visit www.irs.gov after all they are the source for this information.

It is complicated and these pages are

meant

to be informative about income

tax backets and yet always subject to the

IRS' changes etc.

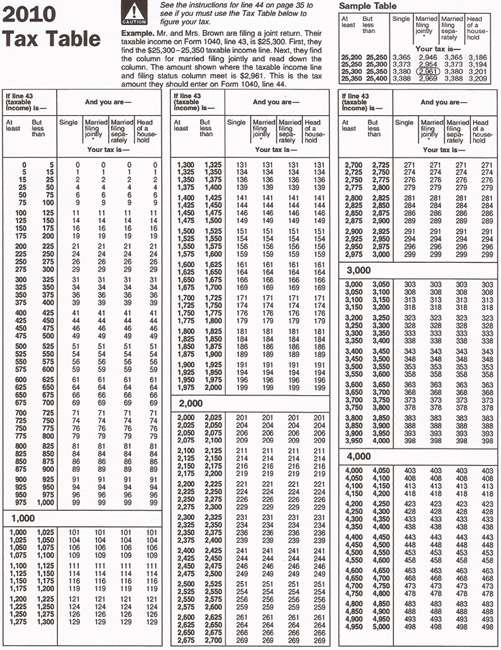

At the bottom of the page is an image of the very specific 13 page PDF file of the 2010 Tax Table. You can download it and print it if you want to.

If Taxable Income Is:

| SINGLE |

MARRIED JOINT FILING |

|

|

| Up to $8,375 |

Up to $16,750 |

10% |

| $8,375. - $34,000 |

$16,750 - $68,000 |

15% |

| $34,000 - $82,400.00 |

$68,000 - $137,300 |

25% |

| $137,300 - $209,250 |

$82,400 - $209,250 |

28% |

| $171,850 - 373,650 |

$209,250 - 373,650 |

33% |

| More than $373,650 |

More than $373,650 |

35% |

Info from IRS.gov

Download a clear 13 page printable

PDF file of the 2010 tax tables |

Below -smaller image of page 1 of the 2010 Tax Table

Click on it to download the full sized 13 page PDF file

For more detailed tax information go to www.irs.gov

|

|